non filing of income tax return

Twice the rate stated in the relevant Income Tax Act provisions. The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less.

Affidavit Of Non Filing Of Itr Pdf Affidavit Payments

663 total views.

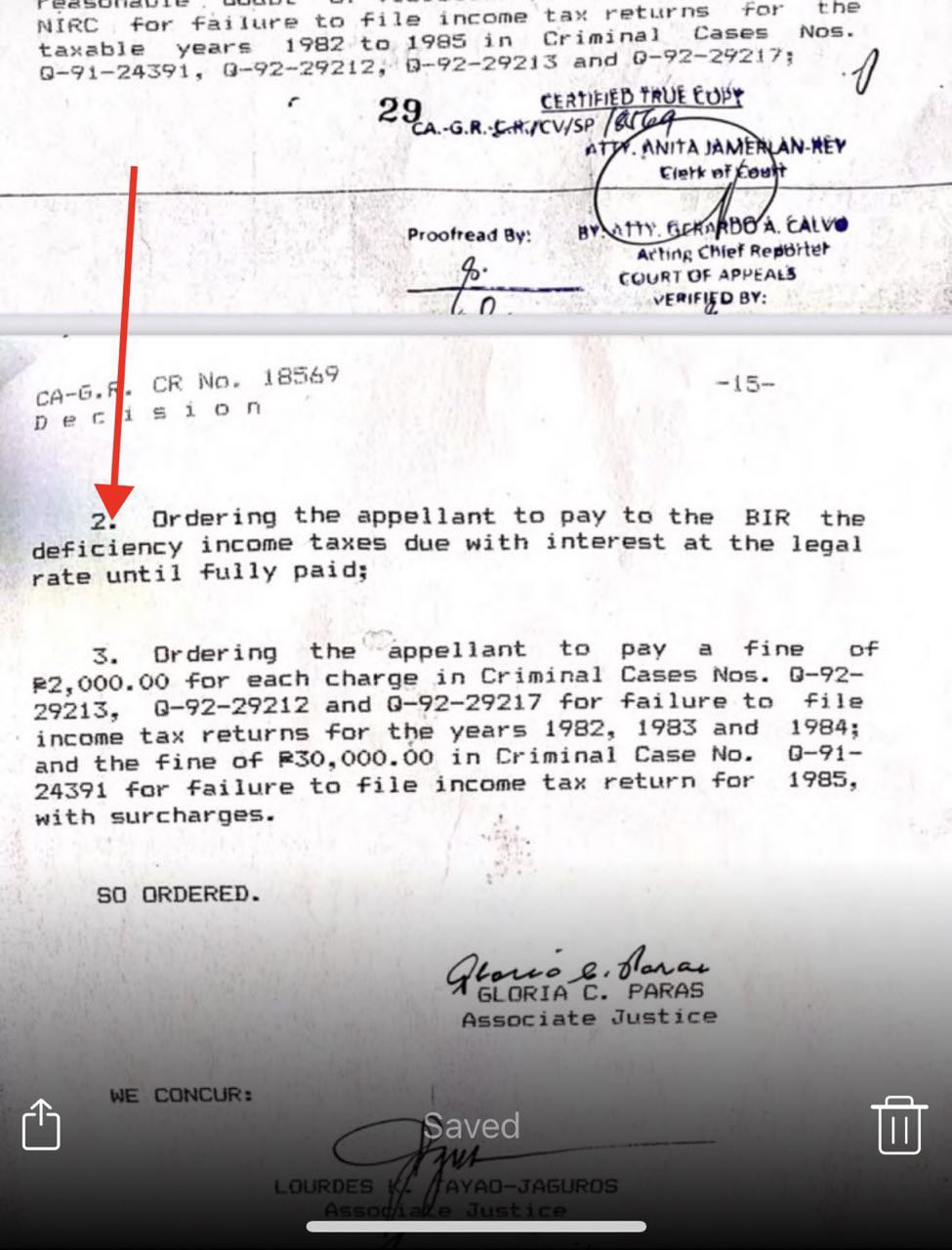

. Ordering the appellant to pay to the BIR the deficiency income taxes due with interest at the legal rate until fully paid. By law they only have a three-year window from the original due. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due.

The failure-to-file penalty grows every month at a set rate. Similar to TDS if a person has non filed. AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1.

Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties. Mailing in a form. The presence of substantial dependents is used as the primary test for determining.

The types of taxes a deceased taxpayers estate can owe. Non Tax filers can request an IRS Verification of nonfiling free of charge from the IRS in one of three ways. At the applicable rate in force as prescribed in the Finance Act.

If you owe taxes and fail to pay them you could face. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years. C onsequences of non-filing of Income Tax Return.

The Failure to File Penalty is 5 of the unpaid taxes for each month or part of a month that a tax return is late. PENALTIES FOR LATE FILING OF TAX RETURNS. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

Make an appointment at your local taxpayer assistance. For getting interest without deduction of tax at source non-senior citizens can file form 15G and senior citizens have to. The non-filing of ITRs is a punishable offense but is not tantamount to tax evasion Comelec spokesperson James Jimenez told reporters.

Return of Income The best income tax lawyers in Karachi and Islamabad are here to help you file your FBR income taxes on time and avoid becoming an income tax non-filer. For possible tax evasion exceeding Rs25 lakhs. Many people may lose out on their tax refund simply because they did not file a federal income tax return.

Ordering the appellant to pay a fine of P200000 for. 16 Oct 2022 0649 PM IST Balwant Jain. Belated return under section 139 4 for the financial year 2021-22 can be filed at any time before the expiry of one year from the end of the relevant assessment year AY 2022-23.

Policy Statement 5-133 P-5-133 IRM 1214118 Delinquent returnsenforcement of filing requirements discusses delinquent returns and the enforcement filing. To file a non-resident federal income tax return they may need to file the IRS Form 1040-NR. The penalty wont exceed 25 of your unpaid taxes.

The Comelec does not say that failure to file an. Basically it is a statement that the deducers who have not been liable to deduct a tax or deducted a tax for any quarter within the quarter and who subsequently have not filed any TDS statement.

Verification Beyond The Basics Ppt Download

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

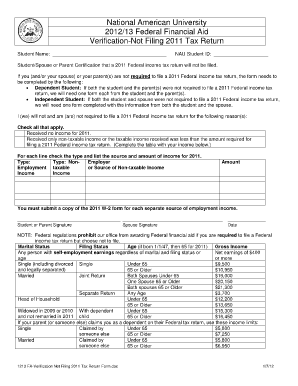

Non Filing Tax Form Fill Online Printable Fillable Blank Pdffiller

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

Filing A 2020 Tax Return Even If You Don T Have To Could Put Money In Your Pocket Internal Revenue Service

Irs Explains How To File Returns To Receive Economic Impact Payments Journal Of Accountancy

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To File A Zero Income Tax Return 11 Steps With Pictures

What Happens If Itr Is Not Filed What Are The Consequences

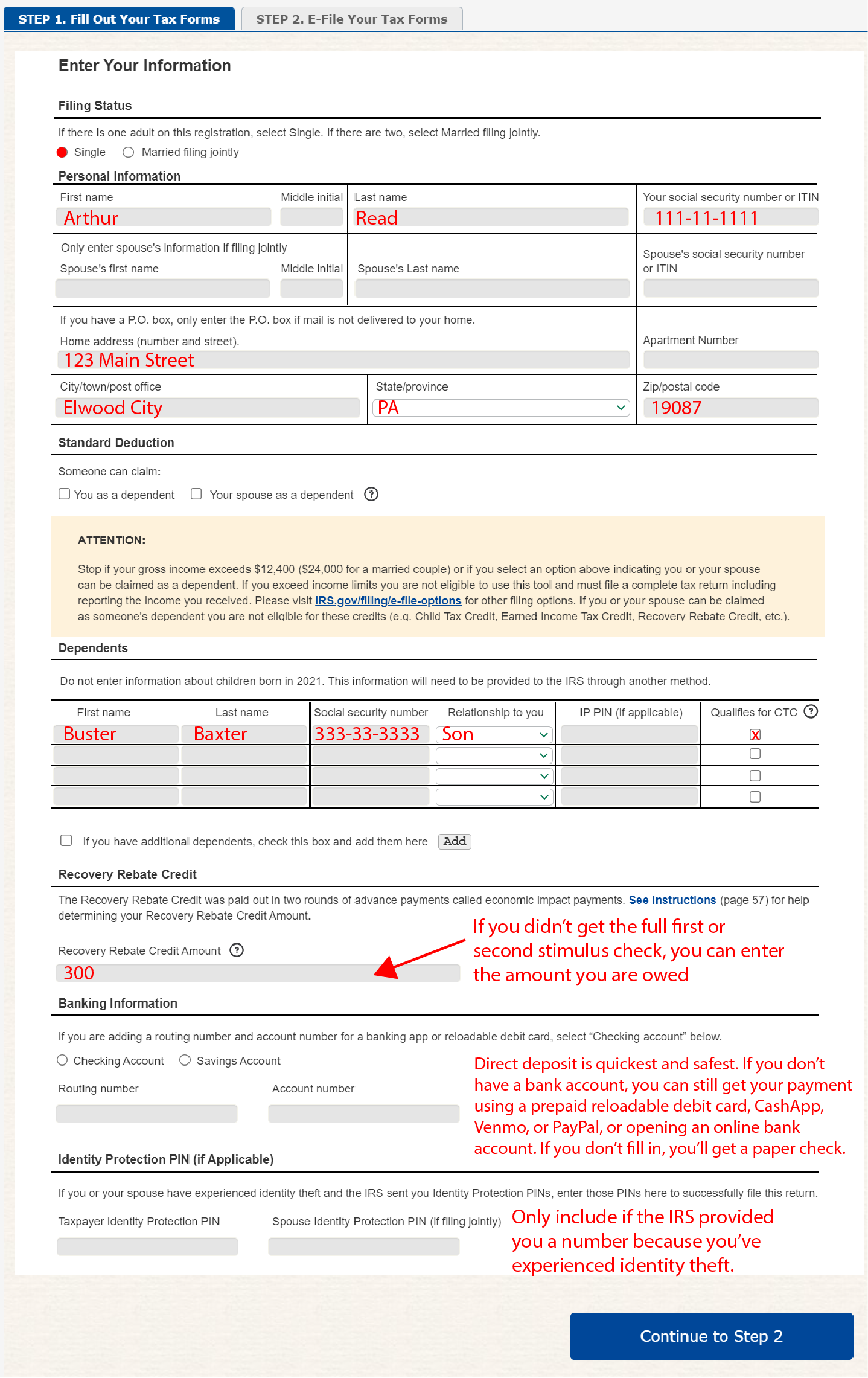

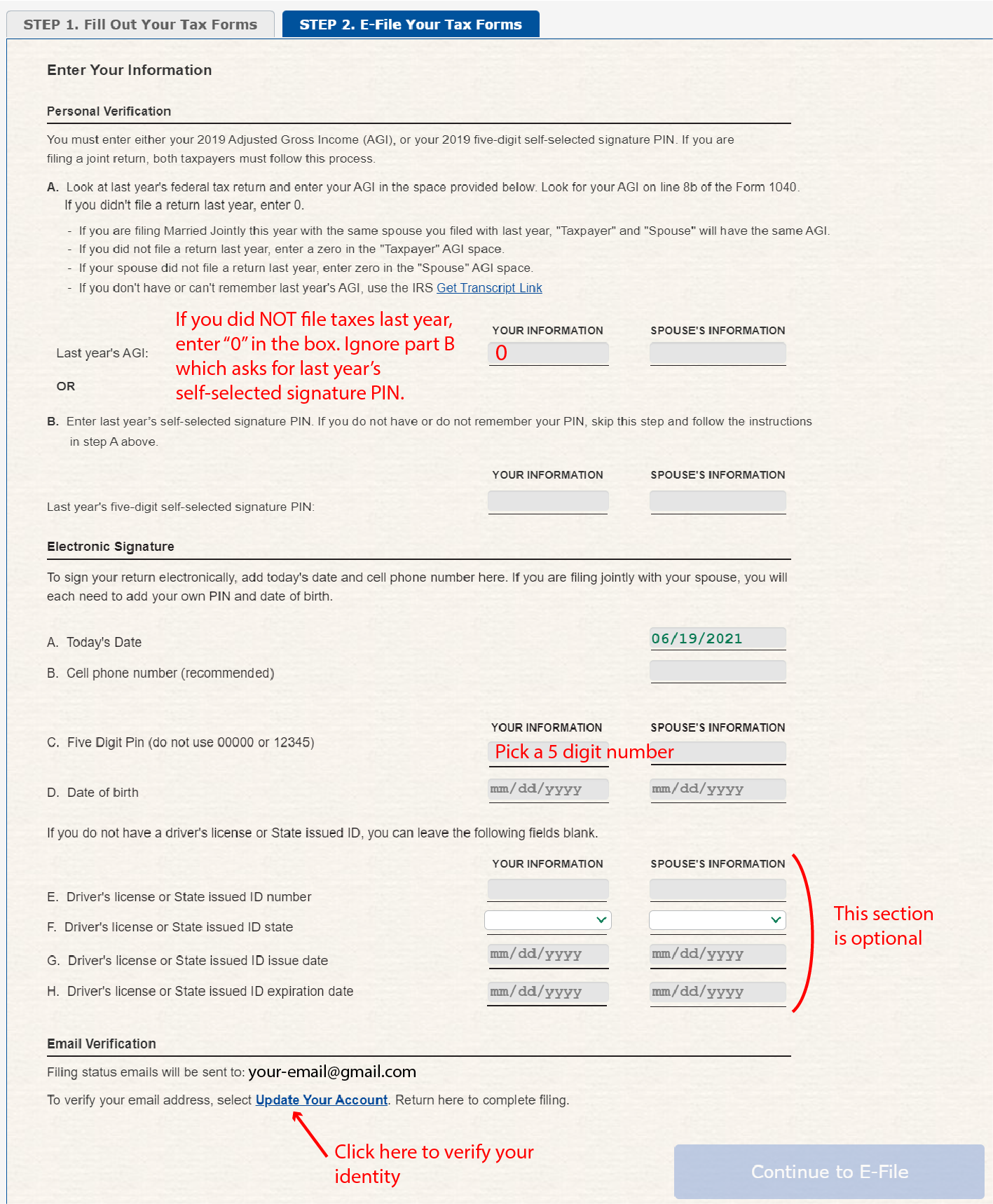

How To Fill Out The Irs Non Filer Form Get It Back

Consequences Of Late Filing Of Income Tax Return Itr

How To File A Zero Income Tax Return 11 Steps With Pictures

تويتر Jamela Alindogan على تويتر This Is False The Court Of Appeals Decision That Became Final And Executory Expressly Ordered Marcos Jr To Pay Deficiency Income Taxes Due With Interest

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Faq Internal Revenue Service Irs How Can I Complete The Verification Of Non Filing

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

How To Fill Out The Irs Non Filer Form Get It Back

Previous Years Non Filed Tax Returns Genesis Tax Consultants

Not Filing Your Income Tax Returns On Time You Could Be Prosecuted Rahul Jain Nangia Andersen India Pvt Ltd